The Systems module provides an overview of systems that have been created, purchased and sold. In addition, plans can also be created. The systems can be divided into different groups, e.g. according to classes, cost centers or locations. The assignment to cost centers can also be made on a percentage basis for an asset group. This makes it possible to include planned depreciation and sales in reports. Several systems can be combined into one main system or divided into individual systems. This is necessary if only parts of the plant are to be sold.

In addition to managing assets, the module ensures that periodic depreciation is carried out correctly. It also allows you to track maintenance costs and manage asset-related insurance policies and book asset transactions, as well as display different reports and statistics. The attachments are kept in a subledger.

In Microsoft Dynamics Business Central, it is possible to set up multiple depreciation books to account for the different types of depreciation. The Investments module has the following depreciation methods under commercial and tax law: •Linear • Declining 1 (depreciation during the year is carried out according to the depreciation method linear) - This method requires a fixed annual percentage to be entered. - The annual depreciation amount is broken down to 1/12 when calculated monthly. This results in the same amount each month (linear in the monthly view of a financial year)

• Declining 2 (depreciation during the year is carried out according to the depreciation method degressive) - Charges the same annual depreciation amount as Declining 1. - If several depreciation runs occur during the year, the degressive method results in 1 equal depreciation amounts per period, and the degressive method results in 2 decreasing amounts per period

• Degr1/Linear (The higher of Linear or Decreasing 1 is used.) • Degr2/Linear (The higher of Linear or Decreasing 2 is used.) • Table (e.g. depreciation related to work units) •Manual

An unlimited number of depreciation books can be set up. Any combination of an asset number and a depreciation book code is called a depreciation book. As many depreciation books as desired can be assigned to an asset – the only limit here is the number of books set up. An unlimited number of depreciation books can therefore be set up for each system. It is not necessary to connect every depreciation book with all investments. The individual systems can therefore use a different number of depreciation books. However, it must be decided for each depreciation book whether it should be integrated into the financial accounting. Financial accounting integration means that all transactions posted to the depreciation book are also posted to the corresponding accounts in financial accounting. The asset is integrated into the general ledger using posting groups.

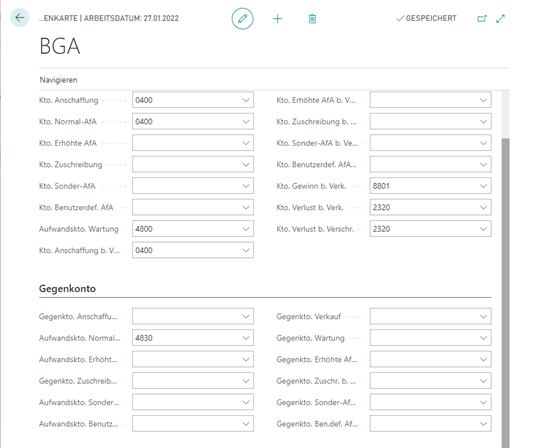

The fixed asset posting group links fixed assets to the balance sheet accounts of fixed assets and the P&L accounts for depreciation. The structuring of the fixed asset posting groups must be based on the structuring of both the balance sheet accounts of the fixed assets and the P&L accounts for depreciation in order to be able to control them correctly via the fixed assets.

For each system, maintenance costs and the date of the next maintenance can be recorded. Monitoring maintenance costs is important for cost planning and can be helpful in deciding whether to replace a piece of equipment.

It is possible to assign one or more insurance policies to each investment. In this way, it is very easy to check whether the amounts of the insurance policies correspond to the values of the investments assigned to the policies. This makes it easier to keep track of annual insurance premiums.