The G/L chart forms the basis for G/L account accounting. In the G/L account plan, the movements from all business transactions are ordered objectively. On the basis of the G/L chart of accounts, the elementary evaluations, such as the balance sheet and P&L, are defined and made available in chart accounts.

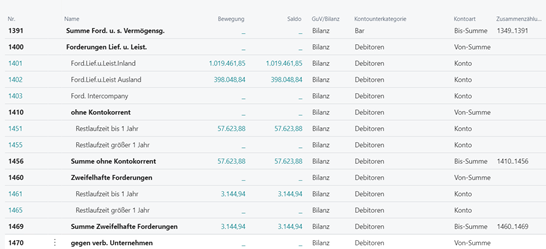

The chart of accounts is set up in consultation with the customer. The structuring of the G/L accounts can be freely selected. The G/L account numbers can be alphanumerically max. 20 digits. The chart of accounts can be further structured or grouped using an account type in order to define account ranges more quickly for evaluations. Master data management can be used to set up consistency of the chart of accounts across defined clients if several clients have the same chart of accounts.

Further information on the G/L account is: • Account type (heading, account total) • Tax posting groups (for manual postings) • P&L/balance sheet indicator • OP-managed G/L account • Blocking license plate • Direct posting (differentiation between automatic G/L account and directly bookable G/L account)

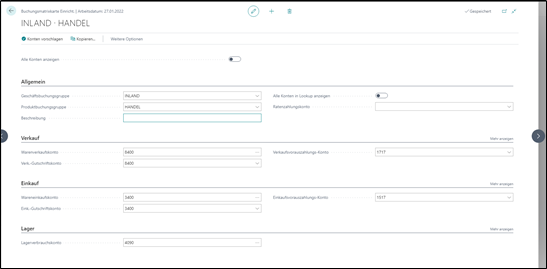

With the help of so-called posting groups, the integration of subledgers (debtors, vendors, banks, assets, articles) into the general ledger is regulated.

In the ERP posting matrix, the accounts are defined that are to be automatically addressed and are relevant for financial accounting (for example, incoming/outgoing invoice) when posting transactions are posted in ERP. Control is carried out via posting groups, which depend on the business partner (customer/vendor) on the one hand and on the product (article, asset, resource) on the other. The corresponding account is determined in the combination. The purchasing, sales and warehouse modules will be integrated.

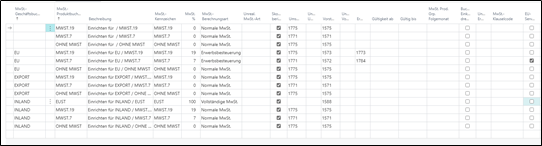

In addition to the merchandise management posting matrix, the VAT posting matrix is also set up. As with the merchandise management posting matrix, the tax is calculated and the tax accounts are determined via the business partner and the product in an underlying business transaction. VAT is billed based on the VAT statement summarized in Microsoft Dynamics 365 Business Central.

The financial dimensions are defined by financial accounting (controlling) and are entered automatically or manually during postings. These dimensions are additional attributes of a G/L posting and can be integrated into various evaluations in reporting. In addition to two main dimensions (which can be evaluated directly), six other dimensions can be created and booked. The dimensions can be selected per booking process by the user or automatically pre-assigned by selecting other data. By default, the following global dimensions are available. These can be extended by any dimensions. A maximum of 8 dimensions can be used. - Globale Dimension 1: Kostenstelle - Globale Dimension 2: Kostenträger - Weitere Dimensionen