The Innercompany process is also referred to as intra-Community transfer, i.e. in the process of relocation between storage locations, a national border is crossed in one and the same client or company. This results in a tax change.

In order to generate an INTRASTAT declaration that is sufficient for the authorities, the stock transfers must be tracked in the system in the form of sales invoices/sales credit memos for the transferring storage location and purchase invoices/purchase credit memos for the receiving storage location.

Specifically, this process can occur if, for example, a wholesaler in AT supplies a customer in Germany. The depositing location is in AT and the receiving location is in DE.

The adjustments to the internal company process are limited to the postings of stock transport and sales orders with transfer customers

Posting a stock transfer in the form of an invoice or credit memo in the processes

Sales order

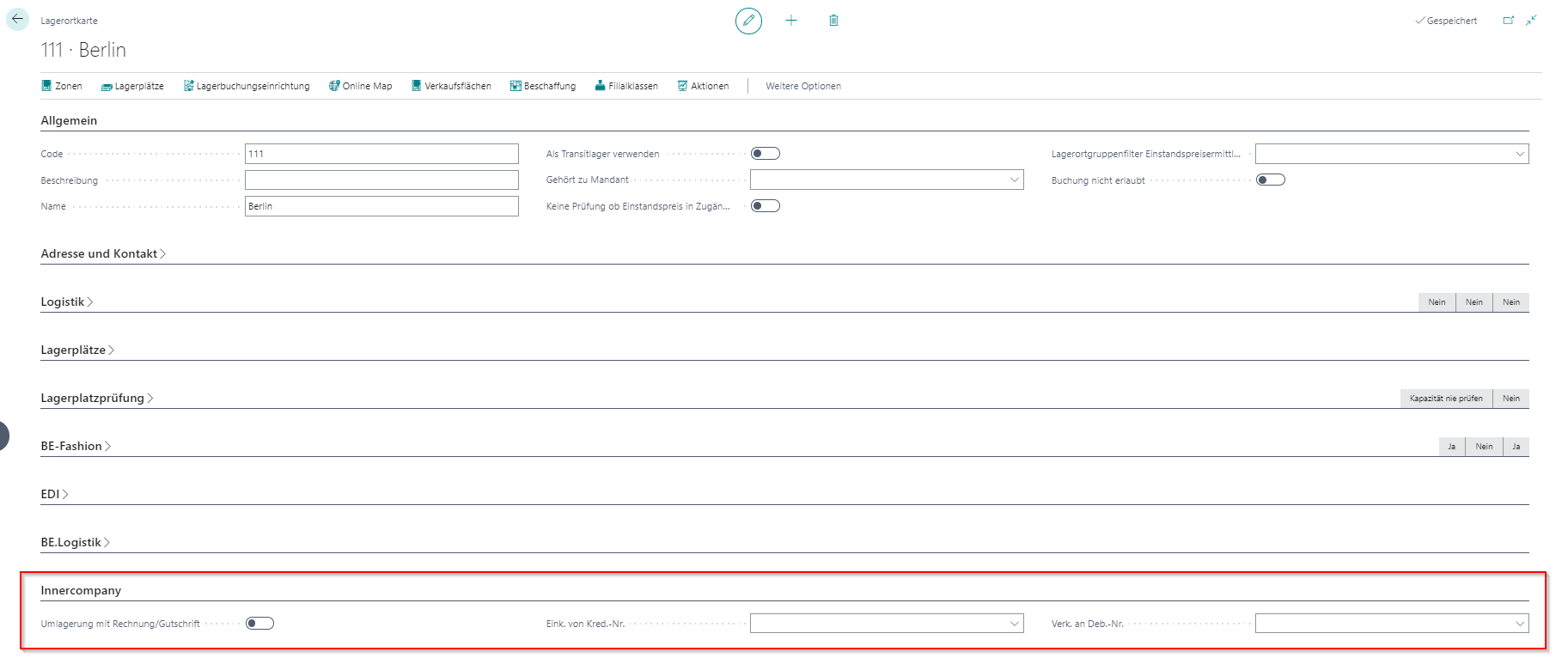

Storing master data at the storage location

Application Setup/Warehouse/Warehouse/Storage Locations

Verk.-an Debitor

Accounts payable with their own posting groups for account assignment and tax registration (VAT IDN) of the country to which the delivery is made.

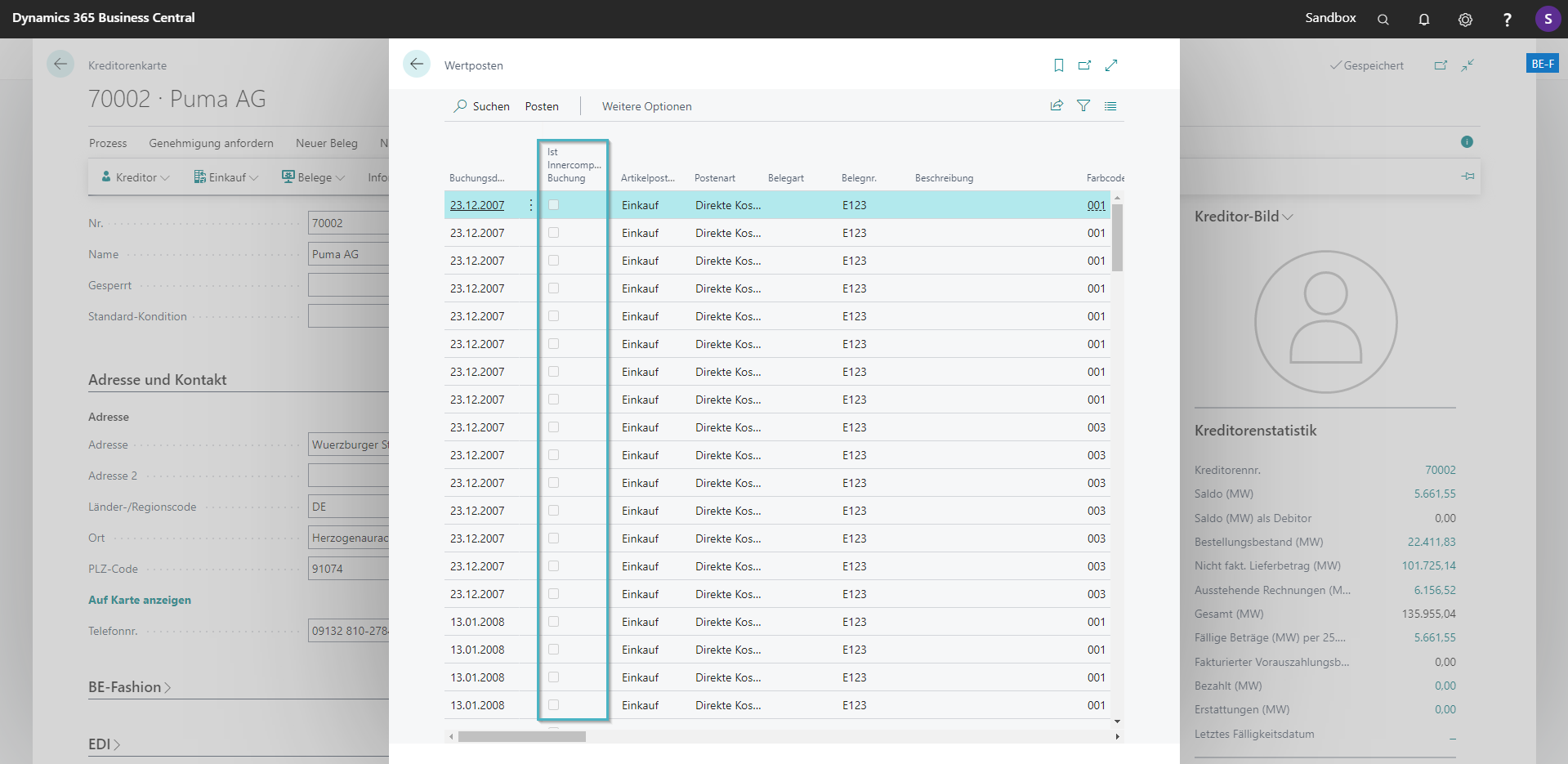

Marking of receipts/items:

- Sales Order

- Stock Transport Order

- Item Items

- Value account

In the following processes, a consistency check is carried out between the sales-to-customer and the purchase-of-vendor at the storage location and a consistency check of the documents created. - Sales order: when posting the sales delivery - Goods issue: when posting goods issue - Stock Exchange: when posting the stock transfer

No prices incl. VAT on customer

Consistency check of receipts: