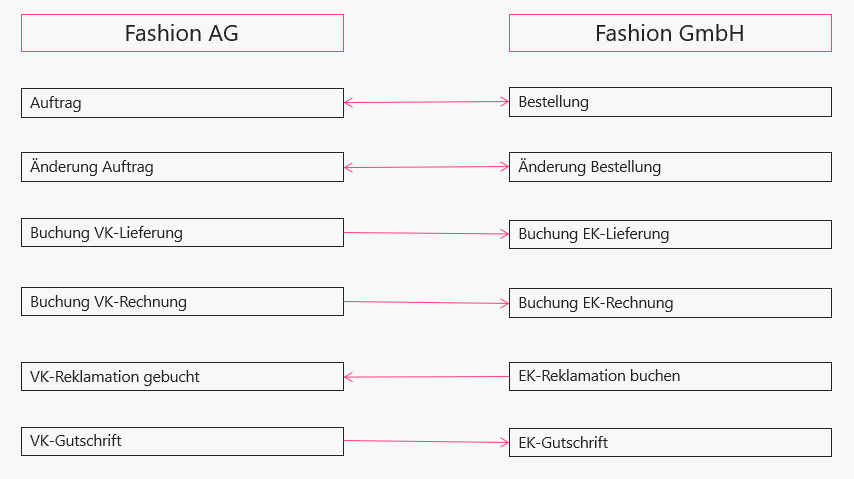

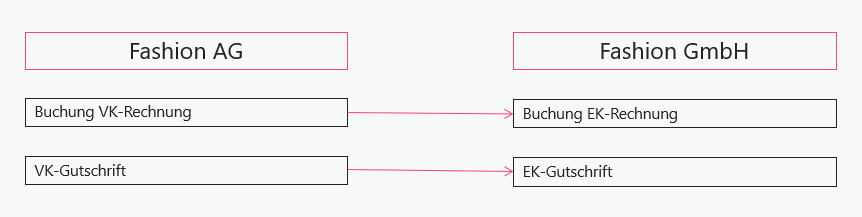

A cross-company transaction takes place between the clients (intercompany processing). The recording of receipts is to be minimized and, ideally, automated.

The definition and setup of intercompany is described in detail in the Microsoft Business Central documentation: https://docs.microsoft.com/de-de/dynamics365/business-central/intercompany-manage

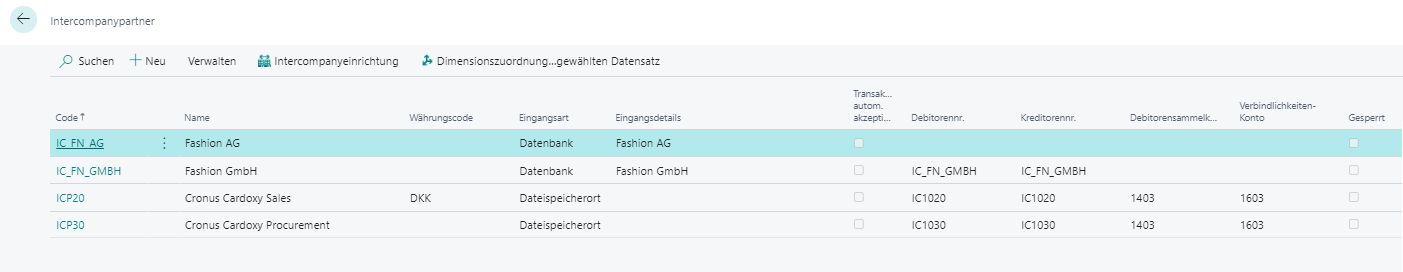

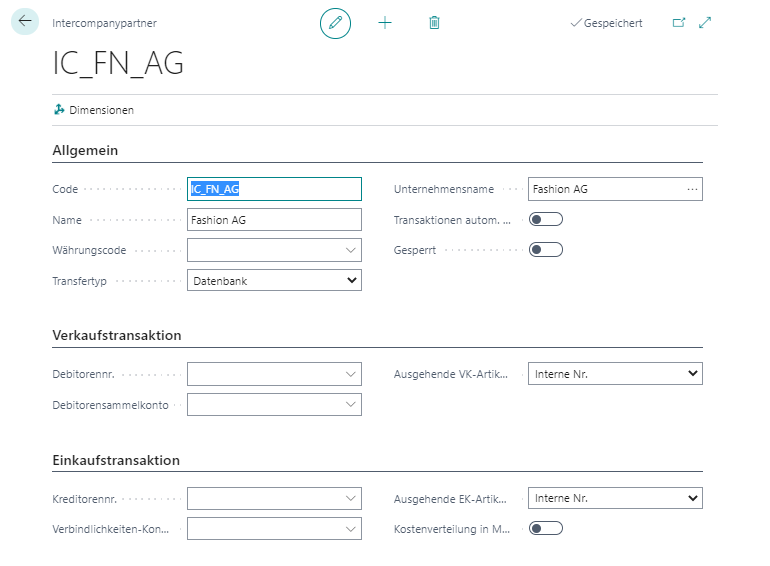

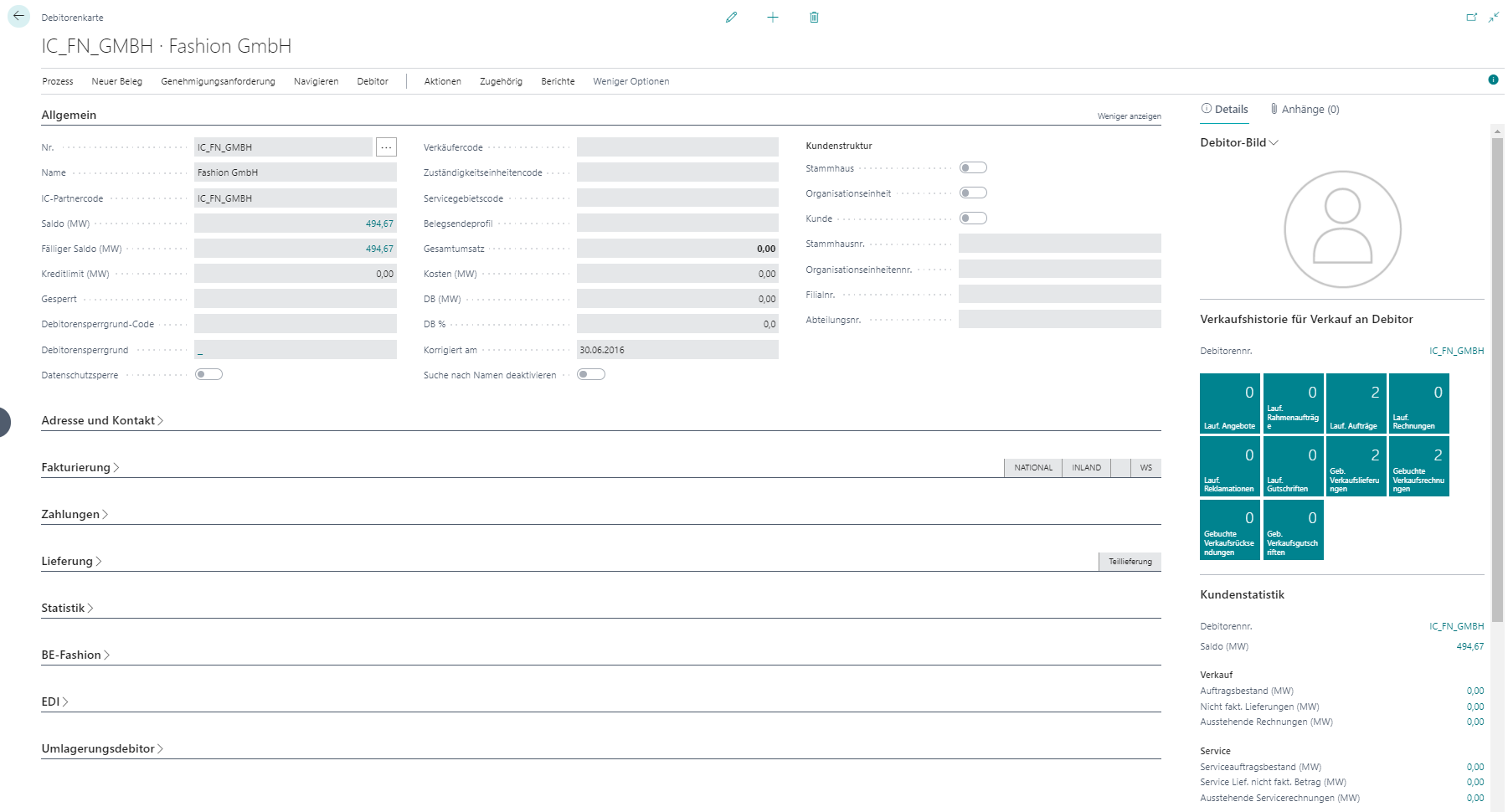

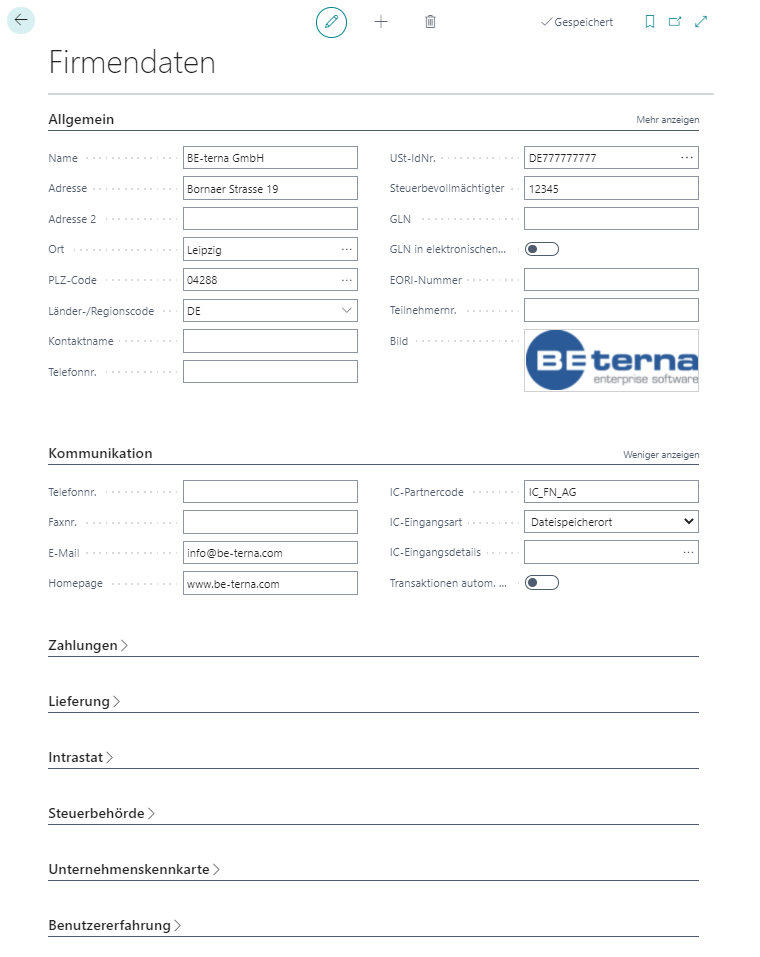

The necessary intercompany customers and intercompany vendors must be set up in the master data beforehand.

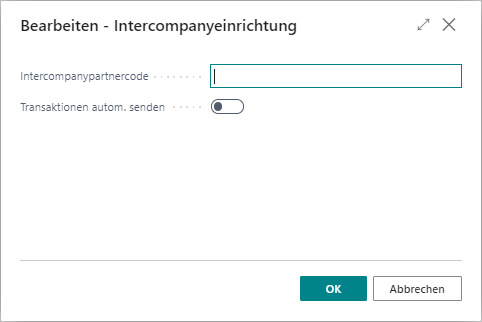

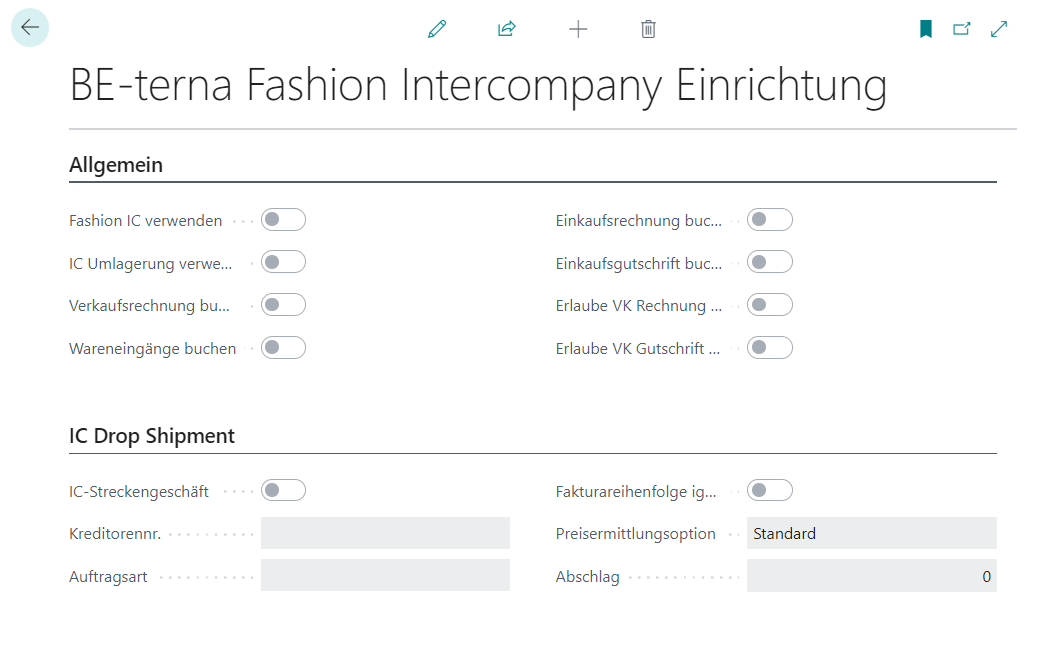

As well as the BE-Fashion Intercompany facility.

The prerequisite for IC postings is that the booking is made via the documents (retail invoice and retail credit), and not only via book sheets.

The sales order has a Factbox IC drop shipping to navigate to the end customer sales order as well as the IC purchase order and IC sales order.

At the customer/vendor assignment of the IC partner code.

|Field| Explanation |

|--|--|

|Use Fashion IC| Specifies whether BE-Fashion IC is used instead of Standard Business Central IC. |

|Using IC Stock Transfers| Specifies whether to use the intercompany stock transfer. |

| Post Sales Invoice | Specifies whether the sales invoice that was automatically generated during the IC stock transfer is to be posted automatically in the course of the IC stock transfer. |

| Post Goods Receipts | Should the WE document only be created or posted immediately? |

|Post purchase invoice| Should the purchase invoice only be created or posted immediately |

|Post shopping credit memo |Should the purchase credit note only be created or posted immediately? |

|Allow VK invoice without prior delivery |Specifies whether items can be included in sales invoices without prior sales delivery. |

|Allow retail credit without prior return |Specifies whether items can be included in sales credits without a prior return reference. |

|IC Drop Shipment| |

| IC drop shipping | Activates with the hook. |

| Vendor no. | Vendor to be used in the IC purchase order. |

| Order type | |

| Ignore billing order | The facilities originating from the Cronus are thus overridden.|

| Price determination option | Regarding the purchase order. Choice of: Standard, Discount or Other. |

| Discount | In the price determination option with the selection "Discount", a percentage value is entered. |

|Field| Explanation |

|--|--|

|Use Fashion IC| Specifies whether BE-Fashion IC is used instead of Standard Business Central IC. |

|Using IC Stock Transfers| Specifies whether to use the intercompany stock transfer. |

| Post Sales Invoice | Specifies whether the sales invoice that was automatically generated during the IC stock transfer is to be posted automatically in the course of the IC stock transfer. |

| Post Goods Receipts | Should the WE document only be created or posted immediately? |

|Post purchase invoice| Should the purchase invoice only be created or posted immediately |

|Post shopping credit memo |Should the purchase credit note only be created or posted immediately? |

|Allow VK invoice without prior delivery |Specifies whether items can be included in sales invoices without prior sales delivery. |

|Allow retail credit without prior return |Specifies whether items can be included in sales credits without a prior return reference. |

|IC Drop Shipment| |

| IC drop shipping | Activates with the hook. |

| Vendor no. | Vendor to be used in the IC purchase order. |

| Order type | |

| Ignore billing order | The facilities originating from the Cronus are thus overridden.|

| Price determination option | Regarding the purchase order. Choice of: Standard, Discount or Other. |

| Discount | In the price determination option with the selection "Discount", a percentage value is entered. |

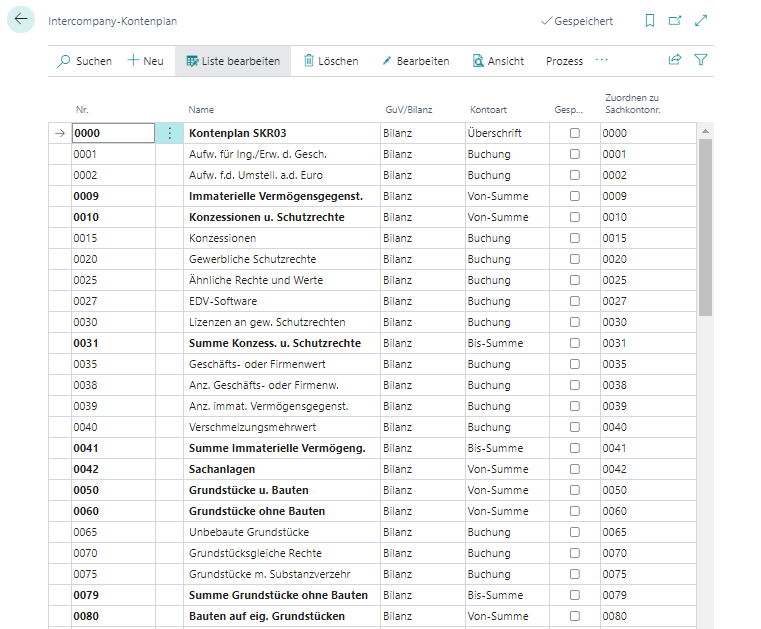

If you are working with G/L account lines in the documents, the IC chart of accounts must be set up.

Mapping between the G/L accounts of the individual clients is possible.

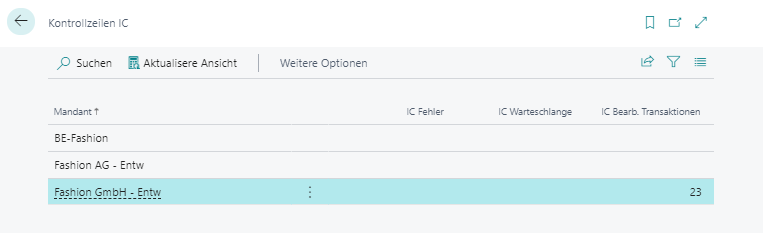

Control Lines IC displays IC transactions per tenant with errors to process queued transactions and processed transactions.

From the IC control lines, it is possible to branch directly to the transaction to be processed by drill-down the queue entries.

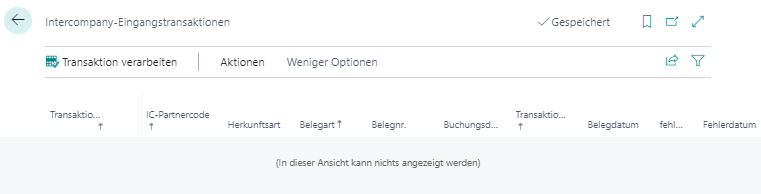

Select the transaction and execute the "Process Transaction" function.

The transactions are processed automatically via NAS call.

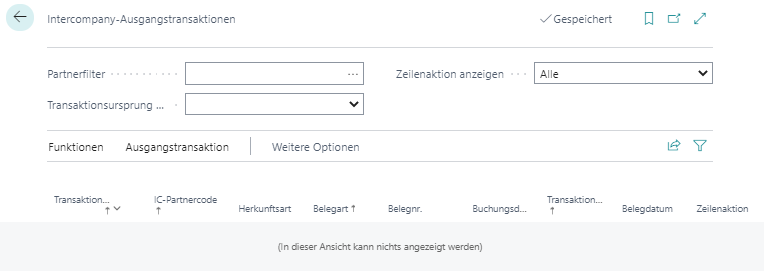

Select the transaction and execute the "Process Transaction" function.

The transactions are processed automatically via NAS call.

The IC price in the orders and orders for internal billing is mandatory. There are several approaches to automatically determine the IC price:

Subsequent value corrections that are defined in a sales document as a surcharge/discount are transferred via IC. This applies to surcharges/discounts that refer to the lines from the invoice, credit memo or sales delivery in a sales invoice or credit memo. The information of the surcharges/discounts is transmitted via an in/out box, similar to IC transactions.